Contract Lifecycle Management Software Market: Streamlining Business Processes and Enhancing Efficiency

The contract lifecycle management (CLM) software market is witnessing significant growth and transformation, driven by the increasing adoption of digital solutions to manage contracts across various industries. In 2023, the CLM software market was valued at approximately USD 2.13 billion, underscoring its critical role in optimizing contract management processes. With a projected compound annual growth rate (CAGR) of 10.4% from 2024 to 2032, the market is poised to expand substantially, reaching USD 5.19 billion by 2032. This growth trajectory reflects escalating demand for automation, compliance management, and operational efficiency in managing contractual agreements.

Key Features and Benefits of CLM Software

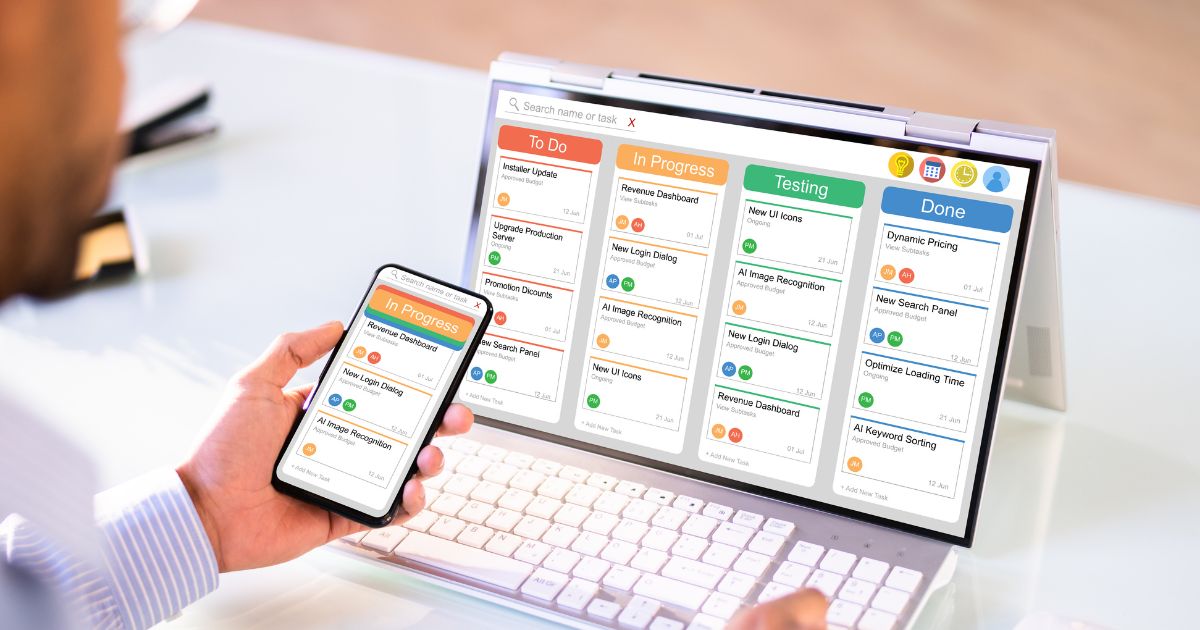

Contract lifecycle management software enables organizations to streamline the entire contract lifecycle, from initiation and authoring to negotiation, execution, and renewal. Key features include:

- Centralized Repository: CLM software provides a centralized repository for storing contracts, facilitating easy access, version control, and document management. This ensures stakeholders can quickly retrieve contract information and maintain accurate records throughout the contract lifecycle.

- Workflow Automation: Automated workflows streamline contract approval processes, reducing manual intervention and accelerating contract cycle times. Workflow automation enhances efficiency, minimizes errors, and ensures compliance with internal policies and regulatory requirements.

- Contract Authoring and Collaboration: Advanced CLM solutions offer tools for contract authoring, redlining, and collaborative editing. Real-time collaboration capabilities enable multiple stakeholders to review, comment, and approve contract terms simultaneously, improving communication and decision-making.

- Risk Management and Compliance: CLM software includes features for risk assessment, mitigation, and compliance monitoring. Built-in alerts and notifications ensure deadlines are met, obligations are fulfilled, and contractual risks are identified and managed proactively.

- Analytics and Reporting: Robust analytics and reporting functionalities provide insights into contract performance, vendor relationships, and financial obligations. Data-driven analytics empower organizations to optimize contract negotiations, renegotiations, and vendor management strategies based on historical contract data and performance metrics.

Market Dynamics and Industry Trends

The adoption of CLM software is driven by several factors, including:

- Digital Transformation: Organizations are increasingly digitizing contract management processes to enhance transparency, reduce operational costs, and improve overall business agility.

- Regulatory Compliance: Stringent regulatory requirements across industries necessitate robust contract management solutions to ensure adherence to legal standards and mitigate compliance risks.

- Remote Workforce: The shift towards remote work environments has accelerated the need for cloud-based CLM solutions that facilitate secure access, collaboration, and document management from anywhere, anytime.

- Integration with ERP and CRM Systems: Integration capabilities with enterprise resource planning (ERP) and customer relationship management (CRM) systems enhance interoperability, data synchronization, and workflow efficiencies across organizational departments.

Regional Insights and Market Expansion

Geographically, North America dominates the CLM software market, driven by early adoption of advanced technologies, stringent regulatory frameworks, and widespread implementation across sectors such as healthcare, financial services, and manufacturing. Europe follows closely, characterized by regulatory compliance mandates and investments in digital transformation initiatives. The Asia-Pacific region presents lucrative growth opportunities, fueled by rapid industrialization, increasing adoption of cloud-based solutions, and government initiatives promoting digital infrastructure development.

Challenges and Opportunities

Despite the growth prospects, challenges such as data security concerns, interoperability issues with legacy systems, and resistance to organizational change pose hurdles for CLM software adoption. However, these challenges also present opportunities for software vendors to innovate, enhance cybersecurity measures, and offer user-friendly interfaces that facilitate seamless integration and adoption.

Industry-Specific Solutions

CLM software providers are increasingly offering industry-specific solutions tailored to meet the unique needs and regulatory requirements of various sectors. For example:

- Healthcare: CLM solutions in healthcare focus on managing contracts with vendors, suppliers, and healthcare providers, ensuring compliance with HIPAA regulations, tracking service level agreements (SLAs), and optimizing procurement processes.

- Financial Services: In the financial services industry, CLM software facilitates contract management for loans, mortgages, insurance policies, and regulatory compliance such as GDPR and Dodd-Frank Act requirements.

- Government and Public Sector: CLM solutions for government agencies streamline procurement contracts, public-private partnerships (PPP), and compliance with government regulations and policies.